Using the power of telematics to become the market leader and innovator

THE CHALLENGE

THE CHALLENGE

Find a way to reward New Zealand drivers to incentivize safer driving and make the roads safer

Tower Insurance is New Zealand's company that has been supporting Kiwis for 150 years and is operating across New Zealand and the Pacific Islands. The challenge in their market was that safe drivers are treated the same as those who are less safe. Safe drivers didn't have any extra benefit, nor did they got rewarded for being conscientious, and that wasn't going hand to hand with Tower's plan to make the roads safer.

THE SOLUTION

THE SOLUTION

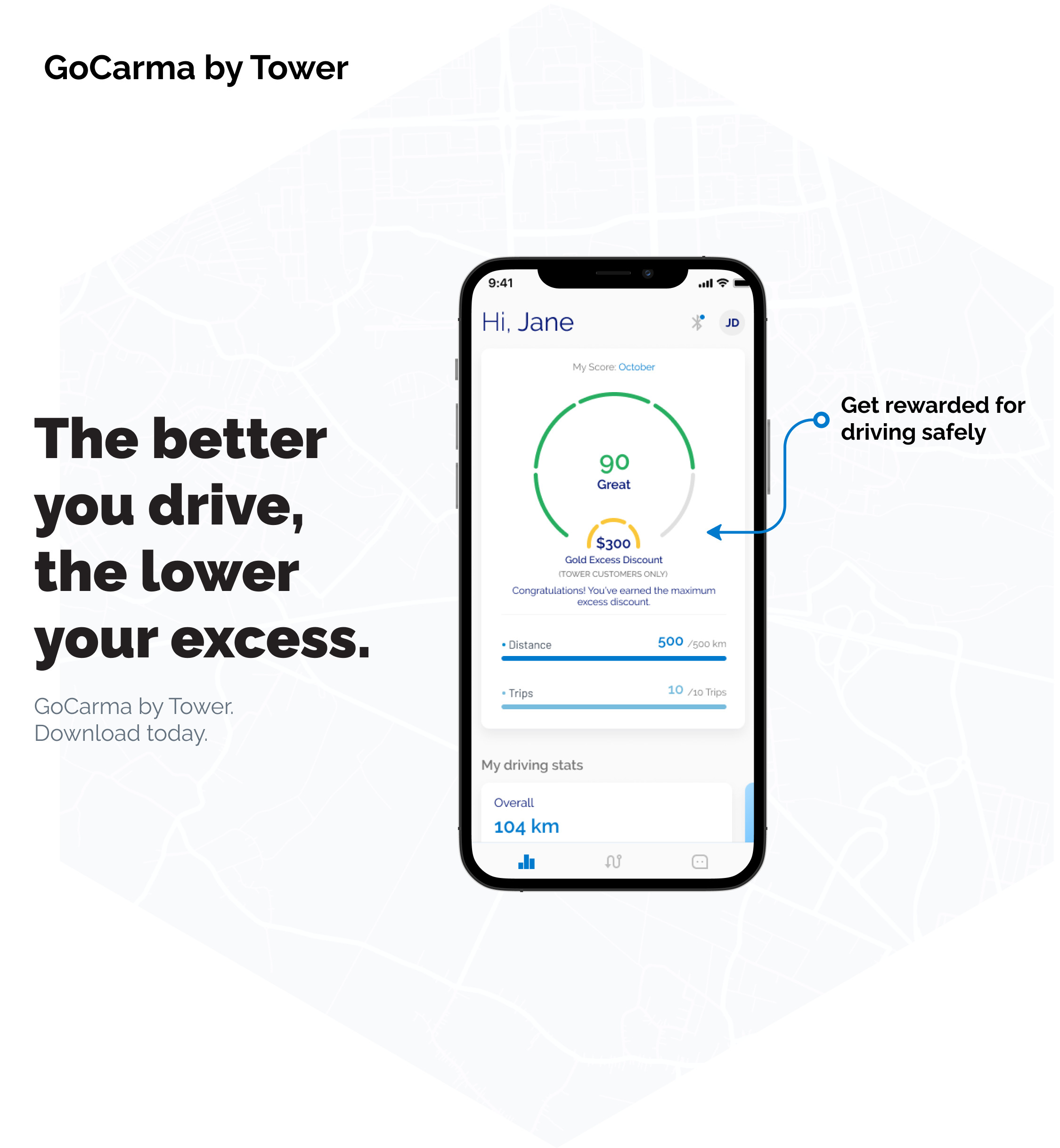

Partnership with Amodo and launch of the GoCarma telematics application

In December 2020, Tower partnered with Croatian InsurTech company Amodo and a new driving app branded GoCarma was launched. Through the application, drivers now can get feedback on their driving capabilities, including harsh acceleration, braking and cornering events, speeding, and phone distraction. The overall score is recalculated after each trip and represents an average of the previous 12 weeks. The underlying Amodo connected insurance platform understands how the user drives, as it correlates data collected from smartphone sensors with both weather and traffic conditions when calculating the final score.

But the driving feedback isn't the only benefit end users get. Tower offers its end users excess discounts ranging from $100 to $300 dollars for users who score over 70/100 points. In addition, the application provides various gamification features such as leader boards and badges, enabling Tower to build long-term relationships with the end-users and make the whole process engaging while motivating the adaption of safer driver behavior at the same time.

GoCarma is designed for all New Zealand's drivers and targets two key segments. The first is "Safety conscious" drivers age 35+ who are motivated by lower claims costs, discounts, and rewards and potentially have teenage children who aren't so experienced on the roads. The second one is "young drivers" age 18 to 35 who are interested both in discounts and rewards as well as gamification features.

THE BENEFIT

THE BENEFIT

Tower resolved the problem New Zealand's safe drivers were facing while it became the leader and innovator at its market

The launch of GoCarma application made Tower a leader and innovator in New Zealand's insurance industry, being the first insurer there to offer telematics to all drivers. By adding a telematic application to their offer, they managed to resolve their customer s problem and gave the ability to reward the good drivers. This telematic app has registered more than 1 million individual trips so far. The data collected has been used to introduce new value for GoCarma users and hopefully have an even more significant impact on overall road safety.

"Tower is proud to have partnered with Amodo, who can share international best practices that we can bring to the New Zealand's drivers to make our roads safer.”

Sally Gordon, Head of Propositions at Tower Insurance.

You have questions about our projects? Ask away: